Overview of Health Insurance in Germany

The German health insurance system is built on a dual structure, comprised of statutory health insurance and private health insurance. Statutory health insurance, also known as public health insurance, provides coverage to a large portion of the population. However, high-earning employees, self-employed individuals, and civil servants have the option to opt for private health insurance. The availability of both systems ensures widespread access to healthcare, though the level of service and benefits can vary significantly. Understanding these fundamental differences is essential when selecting the insurance coverage that best aligns with your healthcare needs and financial situation.

Understanding Statutory Health Insurance

Statutory health insurance in Germany, including AOK and TK, operates on a solidarity principle. Contributions are based on income, and benefits are standardized across all members, regardless of their individual contributions. This means that higher earners subsidize the healthcare of lower earners. While statutory insurance provides comprehensive health insurance cover, it can involve longer waiting times for specialist appointments and limitations on certain treatments. The scope of available health insurance cover is defined by law and is generally considered a basic level of care. Every insured person gets a health insurance card to use when using medical services.

Comparison of AOK and TK

Both AOK and TK are prominent statutory health insurance providers in Germany, offering similar basic health insurance policies to millions of individuals. While their core benefits are largely the same due to the statutory requirements of public health insurance, they differ slightly in terms of additional services and customer service. AOK often has regional variations, while TK is known for its comprehensive online services and focus on preventative care. When comparing AOK vs TK, factors such as specific supplementary benefits (like dental coverage or alternative medicine), customer satisfaction ratings, and accessibility of local offices should be considered. However, remember that neither AOK nor TK can offer the same level of personalized care and enhanced benefits that you might find with private krankenversicherung.

Private Health Insurance Companies

Private health insurance companies in Germany offer a different approach to healthcare coverage. Unlike statutory insurance, contributions are based on age, health condition, and the level of benefits chosen. Private health insurers often provide more extensive coverage, including quicker access to specialists, a wider range of treatments, and the possibility of private rooms in hospitals. Many people take out private health insurance to enjoy these enhanced benefits and greater flexibility in their healthcare choices. However, it's crucial to consider the long-term costs and potential premium increases when evaluating private insurance options. You can usually choose private health insurance if you earn above a certain income threshold.

Book Your Free Consultation Now!

Health insurance in Germany can be simple. Our friendly team helps you find the perfect private health insurance plan, whether you're an employee, freelancer, or applying for a visa. Get personalized assistance and peace of mind.

Benefits of Private Health Insurance

Shorter Waiting Times

One of the most compelling reasons individuals opt for private health insurance in Germany is the significant reduction in waiting times for medical appointments and procedures. Unlike statutory health insurance, where patients may experience delays in seeing specialists or undergoing certain treatments, private insurance policies often grant faster access to care. This can be particularly crucial for individuals with pressing health concerns, as timely intervention can greatly impact treatment outcomes. The ability to promptly schedule appointments and receive necessary medical attention is a key advantage that many people value when they choose private health insurance.

Access to Specialists

Another significant advantage of private health insurance is the ease of access to specialists. Public health insurance often requires a referral from a general practitioner before seeing a specialist, which can add time and inconvenience. Private coverage typically allows you to directly consult with specialists without needing a referral, streamlining the process and enabling more prompt and focused care. This direct access is especially beneficial for those with chronic conditions or specific health issues that require expert attention. The ability to directly access specialized medical care is a major factor driving individuals to switch to a private insurer.

Private Rooms and Enhanced Comfort

Beyond quicker access and specialist care, private health insurance companies also offer enhanced comfort and amenities, particularly when it comes to hospital stays. A significant benefit that distinguishes private krankenversicherung from statutory insurance is the option for private hospital rooms and treatment form head physicians during hospitalization. This not only provides greater privacy and tranquility, conducive to healing, but also often includes additional amenities and personalized attention. With private health insurance in Germany, patients can experience a more comfortable and supportive environment during their recovery. These aspects make private health insurance an attractive option for those seeking a higher standard of care and comfort during medical treatment, in addition to the peace of mind it can provide in the face of unexpected health issues.

Long-Term Cost Benefits of Private Health Insurance

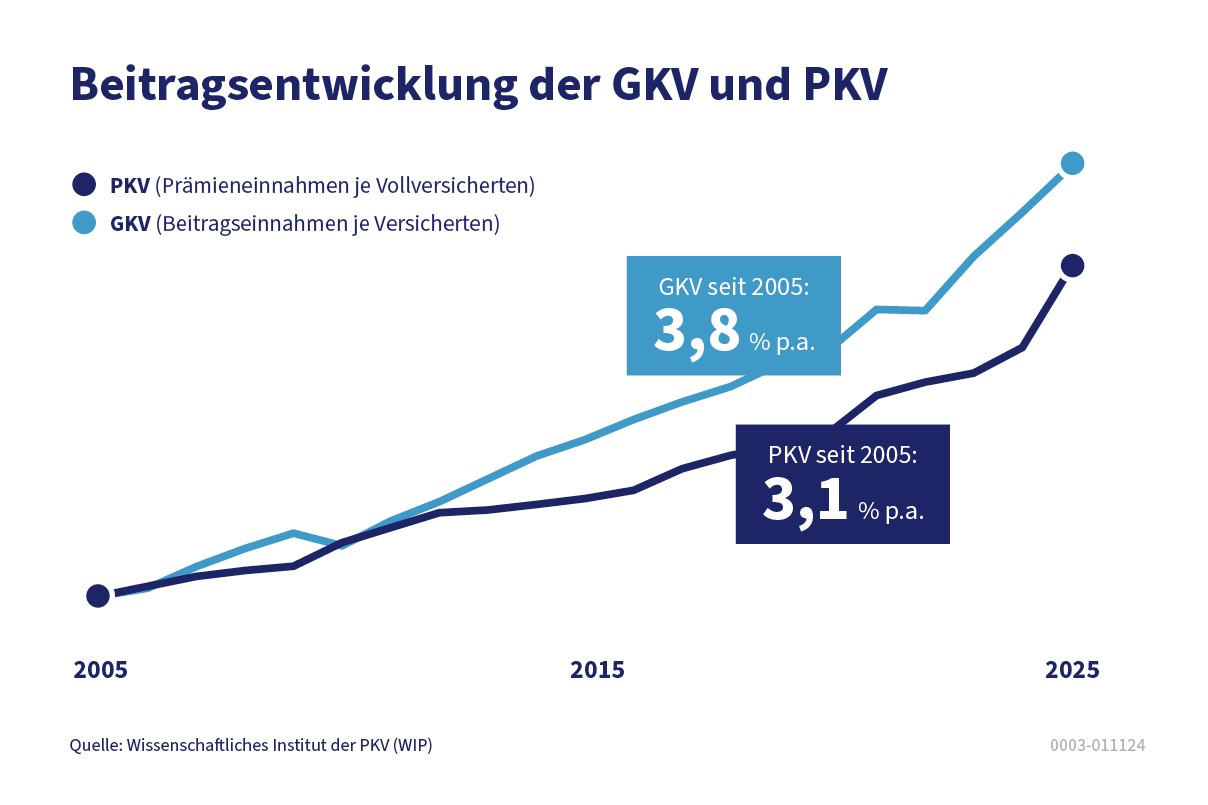

Cost Comparison: Public vs Private Insurance

Private health insurance is often more affordable than statutory health insurance, especially for employees earning above €77,400. While public health insurance contributions are income-based and increase as salaries grow, private premiums depend on age and the chosen coverage. This means high earners can secure excellent benefits at a lower monthly cost. Ageing reserves also help keep private health insurance premiums stable over time. In addition, factors like premium refunds, tax advantages and flexible tariff options can improve the long-term cost balance even further. That’s why a detailed cost comparison between public and private health insurance is essential when choosing the best option.Investment in Health: Care Insurance

Future Financial Considerations

When assessing the long-term cost benefits, consider how private health insurance can offer financial stability in later years. Unlike the statutory health insurance system, where contributions often rise with retirement income, private krankenversicherung premiums can remain relatively stable, particularly if you have secured a favorable rate early on. Furthermore, many private health insurance companies offer options for building up reserves to offset potential premium increases in old age. These reserves can provide a cushion against inflation and ensure that your insurance cover remains affordable throughout your retirement. By planning ahead and taking advantage of these financial features, you can maintain access to quality healthcare without straining your retirement income. A well-structured insurance plan is crucial for long-term financial well-being. If you want to take out private health insurance, then doing it sooner rather than later is recommended.

Book Your Free Consultation Now!

Health insurance in Germany can be simple. Our friendly team helps you find the perfect private health insurance plan, whether you're an employee, freelancer, or applying for a visa. Get personalized assistance and peace of mind.

Eligibility for Private Health Insurance

Who Can Switch to Private Insurance?

The possibility to opt for private health insurance in Germany is primarily determined by income level and employment status. Typically, employees who earn above a certain annual gross income threshold are eligible. This threshold is adjusted annually. Self-employed individuals and freelancers, regardless of their income, are also generally eligible to choose private health insurance. Civil servants, or Beamte, also have the option to enroll in private insurance, often receiving subsidies from the government to cover a portion of their premiums. Understanding these eligibility criteria is crucial before exploring insurance options and determining if a switch from statutory health insurance to private health insurance in Germany is feasible and beneficial.

Criteria for Eligibility

Specific criteria for eligibility to switch to private health insurance involve demonstrating proof of income exceeding the designated threshold for employees. For self-employed individuals, documentation of self-employment and income may be required. Furthermore, pre-existing health conditions can influence acceptance by private health insurance companies and may impact premiums. Some private health insurers may require a health assessment or questionnaire to evaluate risk. It's essential to gather all necessary documentation and honestly disclose any pre-existing conditions when applying for private krankenversicherung. Understanding these factors can help streamline the application process and ensure a smooth transition from public insurance to a private health insurance provider.

Understanding Health Insurance Providers

When considering switching to private health insurance, it's essential to carefully evaluate different health insurance companies in Germany. Research the reputation, financial stability, and customer service ratings of various insurance companies in Germany. Compare the different insurance policies and insurance plans offered, paying close attention to the scope of coverage, exclusions, and reimbursement rates. Also, look at the network of doctors and specialists associated with each insurance plan to ensure access to quality healthcare professionals. Understanding the strengths and weaknesses of different private health insurance providers will empower you to make an informed decision that aligns with your individual healthcare needs and preferences.

Conclusion: Making the Right Choice

Evaluating Your Health Needs

Before deciding between AOK, TK, or private health insurance, take a comprehensive assessment of your individual healthcare needs. Consider your current health status, any pre-existing conditions, and the frequency with which you typically seek medical care. Evaluate your preferences regarding access to specialists, waiting times for appointments, and desired level of comfort during hospital stays. Think about your priorities for preventative care, alternative medicine, and dental coverage. By carefully evaluating your health needs and preferences, you can better determine whether the basic coverage offered by statutory health insurance is sufficient or whether the enhanced benefits of private health insurance are more suitable for your situation. The European health insurance card does not offer the same benefits.

Deciding Between AOK, TK, and Private Options

The decision between AOK, TK, and private insurance hinges on a careful comparison of costs, benefits, and personal preferences. AOK and TK provide comprehensive basic health insurance cover under the statutory health insurance system, while private health insurers offer more personalized plans with enhanced benefits. While statutory insurance premiums are income-based, private insurance premiums are based on age, health, and chosen coverage. Consider factors such as waiting times, access to specialists, and the availability of private rooms. Analyze your budget and long-term financial goals, as well as your risk tolerance and preferences for personalized healthcare. By carefully weighing these factors, you can choose the health insurance plan that best aligns with your needs and priorities. It is wise to take out private health insurance if you are young and healthy.

The Future of Healthcare in Germany

The future of healthcare in Germany is likely to see continued evolution in both the statutory health insurance and private health insurance sectors. As the population ages and healthcare costs rise, there will be ongoing debates about the sustainability and affordability of the current system. Technological advancements, such as telemedicine and personalized medicine, will likely play an increasing role in healthcare delivery. Policy changes may impact eligibility requirements, benefit structures, and reimbursement models. Staying informed about these trends and understanding the potential implications for your insurance coverage is crucial for making informed decisions about your healthcare. It's important to have long-term care insurance as well.

FAQ

Book Your Free Consultation Now!

Health insurance in Germany can be simple. Our friendly team helps you find the perfect private health insurance plan, whether you're an employee, freelancer, or applying for a visa. Get personalized assistance and peace of mind.