AOK vs TK

As a high-skilled expat in Germany, your health insurance choice is crucial for ensuring top-quality care and peace of mind. While public health insurance providers like AOK and TK offer basic coverage, private health insurance (PKV) stands out as the superior choice for discerning international professionals. This comprehensive guide explores why private insurance, particularly offerings from companies like Hallesche Krankenversicherung, provides unparalleled benefits for expats in Germany.

Understanding German Health Insurance Thresholds for 2025

Before delving into the benefits of private health insurance, it's essential to understand two critical thresholds in the German health insurance system:

Private Insurance Eligibility Threshold (Versicherungspflichtgrenze):

€77,400 annually for 2026

Expats earning above this amount can choose private health insurance

Contribution Assessment Ceiling (Beitragsbemessungsgrenze):

€77,400 annually for 2026

This is the maximum amount used to calculate contributions for public health insurance

The Advantages of Private Health Insurance for Expat

Book Your Free Consultation Now!

Health insurance in Germany can be simple. Our friendly team helps you find the perfect private health insurance plan, whether you're an employee, freelancer, or applying for a visa. Get personalized assistance and peace of mind.

1. Superior Coverage and Services

Private health insurance in Germany offers a level of care and service that far exceeds what AOK and TK provide:

2. Tailored Plans for Individual Needs

Unlike the one-size-fits-all approach of AOK and TK, private insurers like Hallesche offer:

Customizable coverage plans

Special expat-focused tariffs

Flexibility to adjust coverage as your needs change

3. Cost Efficiency for High Earners

For expats earning over €73,800 annually (as of 2025), private insurance can be more economical. Let's break down the costs:

Public Insurance Cost Calculation (e.g., AOK/TK):

For an expat earning €80,000 per year in 2025:

Calculation based on Beitragsbemessungsgrenze: €66,600

Health Insurance (2025): 16.9% total (including both general and additional contributions)

Monthly contribution: (€66,600 / 12) * 16.9% = €937.95

Employee's share (50%): €468.98

Long-term Care Insurance: 4% (for those with children)

Monthly contribution: (€66,600 / 12) * 4% = €222.00

Employee's share (50%): €111.00

Total monthly cost for employee: €468.98 + €111.00 = €579.98

Private Insurance Cost (e.g., Hallesche):

Ranging from approximately €210 to €410 monthly, depending on chosen coverage and individual factors

Potential Savings Calculation:

Monthly savings:

Best case: €579.98 - €210 = €369.98

Worst case: €579.98 - €410 = €169.98

Annual savings:

Best case: €369.98 * 12 = €4,439.76

Worst case: €169.98 * 12 = €2,039.76

4. Premium Services and Digital Innovation

Private insurers are at the forefront of healthcare innovation:

Digital claim submissions and rapid reimbursements

Telemedicine services

Health apps and preventive care prog

Book Your Free Consultation Now!

Health insurance in Germany can be simple. Our friendly team helps you find the perfect private health insurance plan, whether you're an employee, freelancer, or applying for a visa. Get personalized assistance and peace of mind.

Case Study: Maximizing Benefits with Hallesche

Michael, 33, Investment Banker from the UK in Frankfurt

Chose Hallesche for its comprehensive "Best Care" tariff

Benefits from:

Immediate access to top specialists in Germany

Private room coverage during hospital stays

"Best Doctors" service for international second opinions

Seamless coverage during frequent business trips to Asia and the US

Tax advantages through optimized premium structure

How to Switch to Private Health Insurance

Check Eligibility:

Income threshold: >€73,800 annually (2025)

Self-employed individuals: No income restrictions

Compare Providers:

Research companies like Hallesche for expat-friendly options

Consider using an independent insurance broker like myhealtharebroker

Health Assessment:

Complete a health questionnaire honestly

Application Process:

Submit application forms (available in English)

Provide necessary documentation (residence permit, income proof)

Cancel Public Insurance:

Once approved, cancel your AOK or TK policy

We certainly will assist with this process

Why Private Health Insurance Outperforms AOK and TK

Tailored Expat Solutions: Unlike AOK and TK's standardized offerings, Hallesche provides customized plans for international lifestyles.

Superior International Coverage: While public insurance offers basic EU coverage, Hallesche's global protection is comprehensive and borderless.

Faster Access to Care: Bypass the long wait times common with AOK and TK for specialist appointments and treatments.

Innovation and Digital Services: Hallesche's digital tools and telemedicine options surpass the basic online services of public insurers.

Tax Efficiency: Private insurance premiums can offer tax advantages, a benefit not available with AOK or TK.

Conclusion: Making the Smart Choice for Your Health in Germany

For high-earning professionals in Germany (with annual incomes above €73,800 as of 2025), private health insurance, can offer clear advantages over public options like AOK and TK. With superior coverage, global mobility options, personalized service, and potential cost savings ranging from €2,039 to €4,439 annually, private insurance aligns perfectly with the needs of international professionals.

While cost is an important factor, the quality of coverage and alignment with your healthcare needs should be the primary considerations in your decision. We strongly recommend getting personalized quotes from us to accurately assess your potential savings and benefits.

Invest in your health and peace of mind – choose the premium care and flexibility of private health insurance in Germany. With myhealthcarebroker, you're not just buying insurance; you're securing a healthier, more convenient future in your new home.

FAQ

Am I eligible for private health insurance in Germany?

Can self-employed or freelancers get private health insurance in Germany?

What's the difference in costs between public and private health insurance?

Do I have to pay my doctor's bills in advance ?

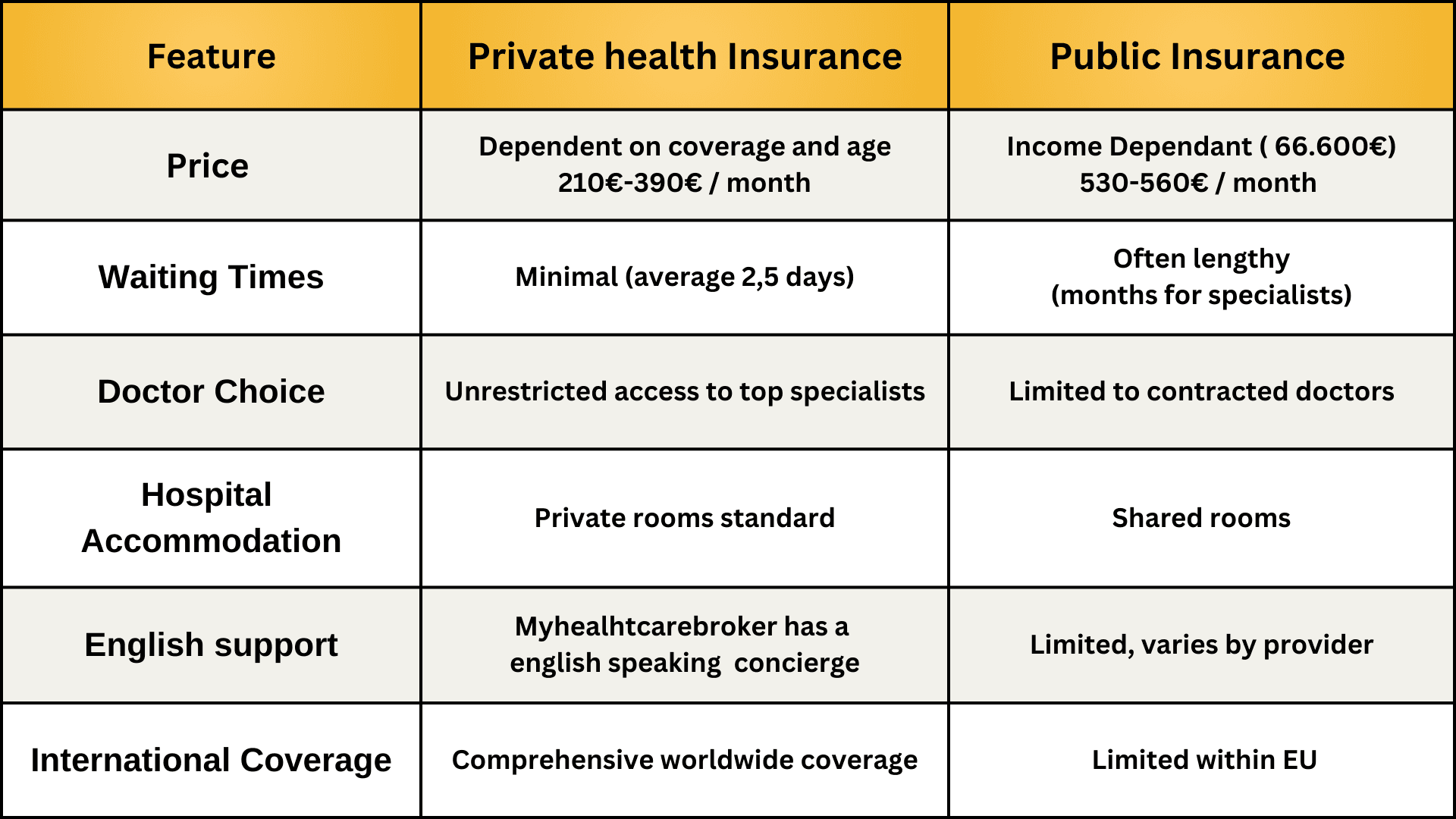

Benefits overview: Public vs. private insurance in Germany

Who has access to private health insurance?

What happens if I leave Germany?

Does the premiums in private health insurance increase with age ?

How do I switch from public to private insurance?

What are the key advantages of private insurance over public insurance?

Book Your Free Consultation Now!

Health insurance in Germany can be simple. Our friendly team helps you find the perfect private health insurance plan, whether you're an employee, freelancer, or applying for a visa. Get personalized assistance and peace of mind.